Assessing the 2021 Crypto Crystal Ball Predictions

Six months in and these predictions need reviewing

Six months ago, Soona Amhaz of Volt Capital hopped around the crypto-sphere, asking people what their predictions were for the industry ahead of the year 2021. So many things have happened already, both good and bad, that it is worth spending some time to review the progress of some of the most interesting & sexy predictions made.

Meltem Demirors, CoinShares

Bitcoin becomes globally championed as the antidote to dysfunction. Bitcoin breaks $100k and the institutional buying begins in earnest. Bitcoin mining breakout in 2021 — we see North American mining and mining with renewables dominate the narrative.

Whilst Bitcoin is indeed indulging in legitimisation via institutionalisation, it would be overzealous to claim that it is “globally championed as the antidote to dysfunction.”

On the other hand, the most respected companies and individuals on this planet are beginning to endorse Bitcoin. The world’s wealthiest man (Elon Musk), the world’s largest money-manager (BlackRock) and the world’s largest custodian (BNY Mellon) are now involving themselves with Bitcoin in one way or another. You can also add Ray Dalio, Goldman Sachs, JP Morgan, TIME Magazine, VISA, Mastercard & PayPal to that list.

In a Nostradamus-like fashion, Meltem correctly foresaw the cataclysmic shift in the Bitcoin mining industry. Just months after having purchased over a billion dollars worth of Bitcoin, TESLA and Elon Musk critiqued the carbon footprint of the network, alerting the world to Bitcoin’s power-intensive nature. Since then, price quickly fell from $53,000 to a low of $29,000 and numerous initiatives are in the work and have been for years, to make Bitcoin more eco-friendly (see Great American Mining and Bitcoin Mining Council), making Bitcoin’s energy consumption a major theme of 2021.

To add fuel to the flames, the CCP initiated a crackdown on crypto-mining operations, essentially prohibiting all types of crypto mining, be it clean or dirtily sourced energy. The result? Miners situated in China have had to unplug their rigs, and start selecting a new destination to set up shop. The most popular alternatives appear to be the USA, India, Russia & Kazakhstan, thanks to their cheap energy and ease of issuing necessary permits to plug into the state-owned power grids. Since the exodus began, Bitcoin’s hash rate is down by 50%.

🤵 My prediction for Q3 & Q4: Another globally recongised corporation will endorse BTC and add it to its capital reserves. The violent crash of May 19th will work against Bitcoin’s potential to serve as “the antidote to dysfunction,” as the narrative that it’s a highly volatile asset persists. Although this process will take longer than the six months that remain of 2021, the hash rate will gradually rise to pre-China ban levels, set new highs and then the energy mix of BTC will transition to more sustainable energy sources.

Stacie Waleyko, Casa

Increased usage on the Lightning network. Any kind of bull run is going to force activity onto layer two for wins in scalability and lower fees.

Education and Gen Z adoption.

Whilst momentum has been slow to gather, the Lightning network has taken great strides in Q1 & Q2 of this year. Centralised exchanges were the first to start the trend, after Bitfinex, Kraken, OkEx and Bitstamp all signalled that they will support Lightning payments. But now even a nation state - El Salvador - will leverage Lightning lab’s product and wield it to host everyday payments between merchant and consumers, as well as tax and remmittance payments.

Whilst the market has been demanding Layer 2 solutions for years, now we are beginning to see their supply and usage catch up. Uniswap just had an Alpha Launch on Optimism, Polygon’s rapid adoption catapulted it into the top 15 most valuable coins, and minting an NFT can now cost less than $0.01 thanks to StarkWare.

As games like Axie Infinity, and trading platforms that gameify trading (RobinHood, Binance, etc) continue to develop and capture new funding and users, the rates of Gen Z and Millenial adoption will outpace previous years. Not only are consumers being lured to the land of crypto, but so is talent and labour. This should not come as a surprise given crypto is an industry that was born in their age and designed to cater for them. In contrast, corporate management structures ripe in the financial industry were constructed in the 20th century, for post-war conformists. Us younger lot are a tad more demanding and rebellious, which crypto caters for.

🤵 My prediction for Q3 & Q4: Exchanges and wallets will accelerate the Lightning Network’s adoption, and by EoY it will have locked in over $100-million of BTC. Unless the bulls and the subsequent ability to make money returns, I don’t see any significant shifts in adoption seen from younger generations. Perhaps games and betting platforms can lure some of them, but for an impactful number of new users to join, we need the greater market to show signs of recovery.

Avichal Garg, Electric Capital

In 2021, crypto will start to realize the promises of 2017. Layer 1 protocols have emerging developer ecosystems, DeFi touches tens of billions of dollars, decentralized infrastructure has early product market fit, artists are making significant income via NFTs, and DAOs are managing billions of dollars. Most of the world will not notice these disruptive and transformative developments until 2024.

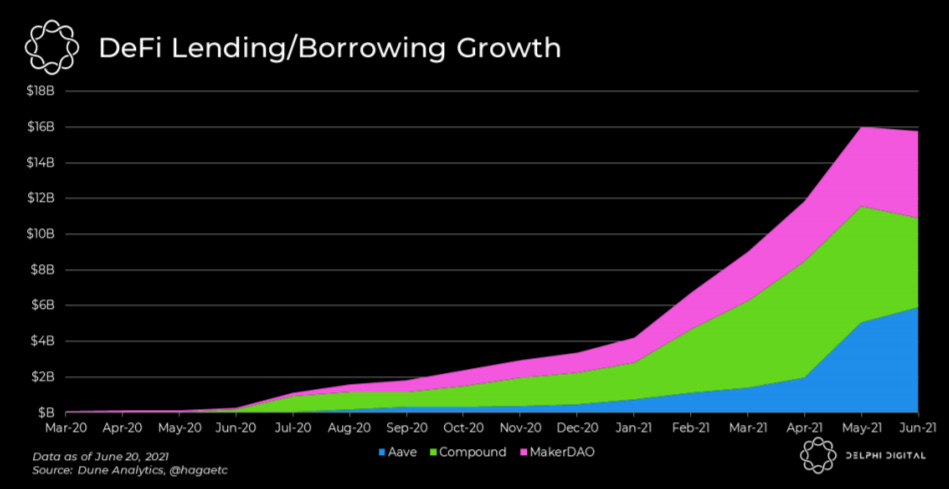

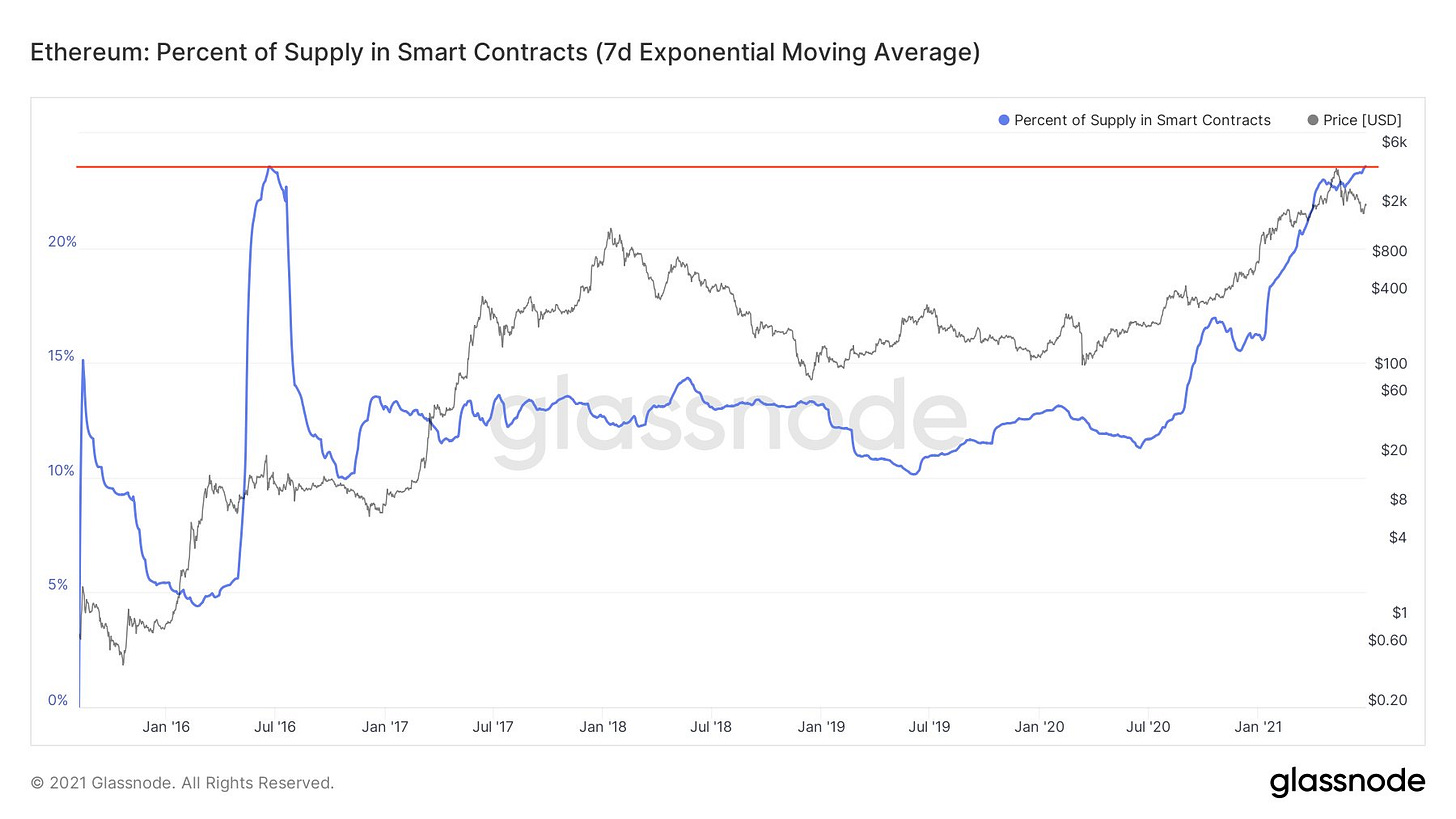

Reaching a peak of $89bn total-value-locked (TVL) in May, DeFi is certainly hosting “tens of billions of dollars,” “boasting an emerging developer ecosystem” and has “early product market fit,” thanks to two major solutions:

(1) Decentralised Exchanges (DEXs)

(2) p2p Lending Marketplaces

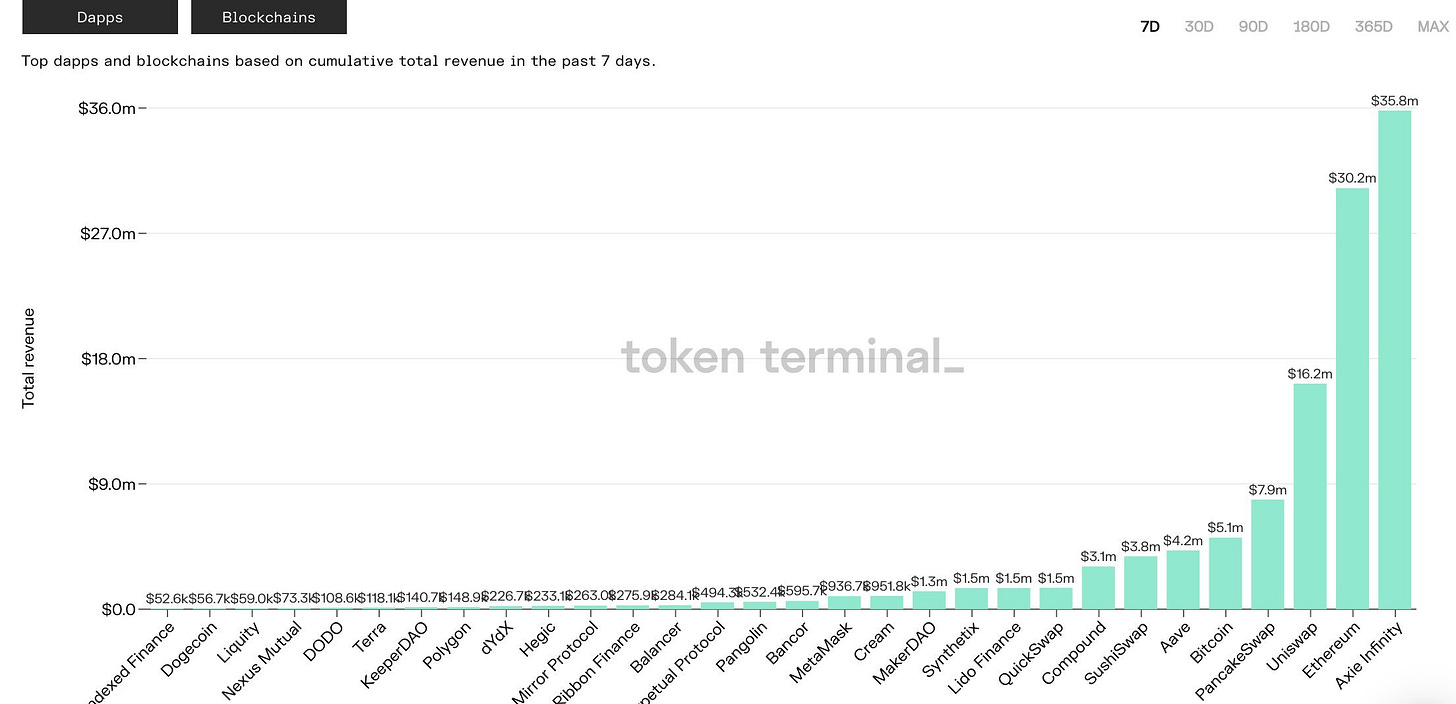

These two categories have dominated the DeFi space, with projects and DAOs like AAVE, Curve, Uniswap & Compound consistently ranking within the top 5 d’apps. All of these products are the result of open-source, collaborative work from a distributed network of passionate developers who all speak the same language, Solidity.

A big reason why these projects have been able to flourish and achieve “early product market fit” is thanks to their ability to make unproductive assets, productive. In previous years, the norm for HODLers was to park their coins on an exchange or in a cold wallet, limiting their function to simply an asset that could appreciate in value. But by lending them out on AMMs like AAVE, or farming across liquidity pools, users can now put their coins to work and use them to generate further yield.

As for DAOs and NFTs, we’ll drool over their progress later in another prediction made.

🤵 My prediction for Q3 & Q4: While we wait for Sharding and Plasma to rollout, Layer 2s like Polygon and Arbitrum will continue to reel in smart contract demand. Altcoins’ USPs of low costs and high throughput will diminish and many projects will slide into obsolence, similar to BSV, IOTA & EOS in the last 12-18 months. The first major Derivative DEX will launch by end of year, setting it up to takeover CEXs’ market share in 2022.

Alexander Leishman, River Financial

The dominant trend of 2021 will continue to be Bitcoin becoming an increasingly attractive place to park wealth and use as collateral.

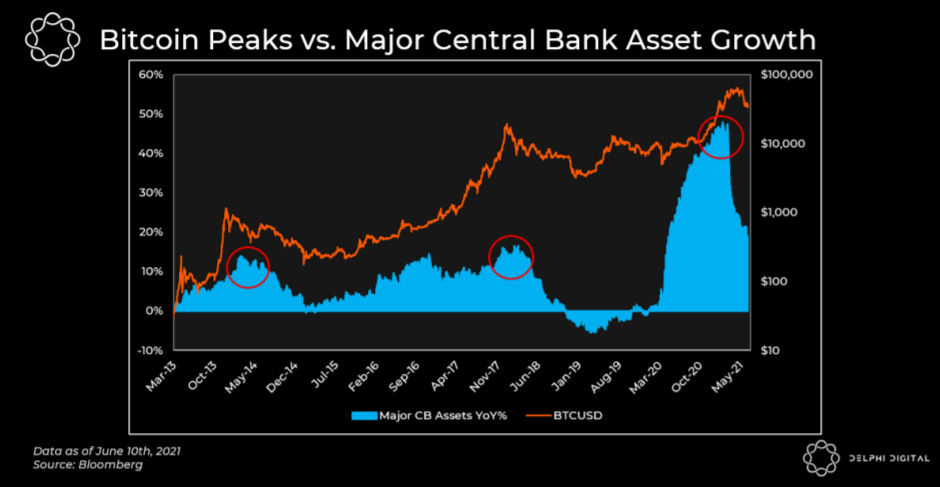

In order for a good to grade as efficient collateral, its value versus fiat currencies has to remain relatively stable. BTC depreciating by over 50% in just 7 days in May indicated that it is not currently suited to serve as an efficient vehicle of collateral.

Historical trends show that BTC prospers off central bank liquidity injections into the economy. After the Fed created 30% of all US Dollars in 2020 and inflation is rising fast, I would put my money on interest rates rising later this year. it would not be uncharacteristic for Bitcoin to slide further, enter a prolonged correction period, and discincentivise investors from using it to “park wealth and use as collateral.”

That being said, there is an active trend in crypto to make unproductive assets productive. One of the more interesting announcements came from AAVE when they recently shared plans to allow users to post their NFTs as collateral when looking to take out a loan.

🤵 My prediction for Q3 & Q4: It all depends on what the price of BTC does in the latter half of the year. If it recovers, superseding key levels like $45k, one can expect continued endorsements from players looking for a vehicle to park their wealth in. If key support at $31k breaks, $20k BTC is likely and then it will (temporarily) lose its allure and ability to act as a store of value.

Clinton Bembry Jr., Slingshot

EIP 1559 will be live by end of 2021.

Total DEX trading volume in 2021 will break $1T.

After much anticipation, EIP-1559 is set to go live in early August. The function of EIP-1559 is to (1) Make GAS costs less volatile and more predictable (2) Improve the UX of paying GAS costs (3) Make ETH more deflationary as a portion of GAS costs will now be burned.

Currently, just below $500 billion and seven months into the year, I’m going to agree with Bembry Jr that total DEX volume will reach $1 trillion by the end of the year, with projects like SynFutures and Synthetix building the products that’ll attract users.

🤵 My prediction for Q3 & Q4: EIP-1559 will be live before the end of the year, probably in Q3. Thanks to the KYC-less nature of them, and the parabolic growth in products and infrastructure, DEX trading volume will continue to grow. Then you factor in how multiple CEXs have recently receieved warnings & investigations from jurisdictions all over the world, and the outlook for permissionless DEXs shines brighter than ever.

Linda Xie, Scalar Capital

We’ll also see large-scale coordination through DAOs and significant experimentation in the personal/social token space with a number of prominent creators issuing their own tokens.

Despite their inherent difficulties, DAOs like UniSwap, Aave and Yearn.finance are coordinating themselves well enough to entice billions of dollars worth of capital to be directed to them. One that I’m particularly interested in is Yield Guild Games which acts as an on-chain guild, that invests in and aims to maximise the value of NFTs used in virtual realms. Revenue will come from:

(1) Guild assets earning revenue in play-to-earn games (eg winning a battle in AXIE)

(2) Guild owned assets could be rented to others, and then a % of their proceeds trickles back into the Guild

(3) Appreciation of NFTs owned

Creator economies are where tokens and NFTs get extremely sexy, thanks to beautiful case studies provided by Disclosure, Gary Vaynerchuk, and Margaret from Twitter that we’re going to go through.

Disclosure NFT case study: A one-of-one collectible in the form of an NFT. Holder of the NFT gains free entry for 4 guests to all Disclosures shows worldwide for as long as they hold it in their wallet. The NFT also features a 30% creator fee, meaning that every time the token is traded, the original creator (in this case Disclosure) receives a 30% rebate for their initial work. The 30% creator fee incentivises Disclosure to only release valuable pieces, and For Dislcosure, the NFT gives them the economic possibilities to monetise their brand, which they lack in the internet’s most recent iteration. Delphi Digital paid $140,000 USDC in the auction where they acquired it. F

Gary Vaynerchuk NFT case study: Gary Vee’s first NFT collection is called ‘VeeFriends’ and is made up of 10,255 tokens. The premise it to create and grow a community of people with similar interests by issuing NFTs with utility that are designed to grow in value over the coming decade. The NFTs that Gary sells all grant the owner access to a yearly conference, with heaps of speakers, activities, workshops and networking opportunities.

People want access to crypto, they want to be a part of a community, they want to make money off their NFT (buy cheap, sell higher) and they want a cool, limited edition, natively digital collectible with multiple perks reserved for exclusive owners. Gary and his team have created this, and monetizsed it by selling access.

Margaret from Twitter: A nocoiner teacher from Plymouth, England, wrote a poem as part of a Twitter content. Twitter then kindly minted her an NFT representing that poem, transferred the ownership to her, and within a couple of hours she had received an offer of $110,000. This is more of an example of an overly inflated NFT due to the recent NFT mania. I expect the price of this particular NFT to plummet, due to its lack of utility and over-supply of similar pieces.

NFTs have the ability to recreate creator economies, removing the burdensome middle-man, and bring content creators and their audience closer together, building a more connected, passionate and active community.

🤵 My prediction for Q3 & Q4: Creators and companies in all industries will continue to mint and auction their own NFTs, surrounding infrastructure will significantly improve (particularly UX) and crypto-gaming will rise as one of the most crucial onramps to introduce nocoiners to the world of crypto.