The Curious Cat is a journey where I aim to reconnect with my inner-child and explore my curiosity. I pinpoint themes & topics I’ve been interested in, ask myself questions about them and then write about them. I hope you find value within this issue and have a fantastic day doing what you love.

A neglected yet crucially important topic that is too often sidelined is the alarming pit of debt that our nations are spiraling into.

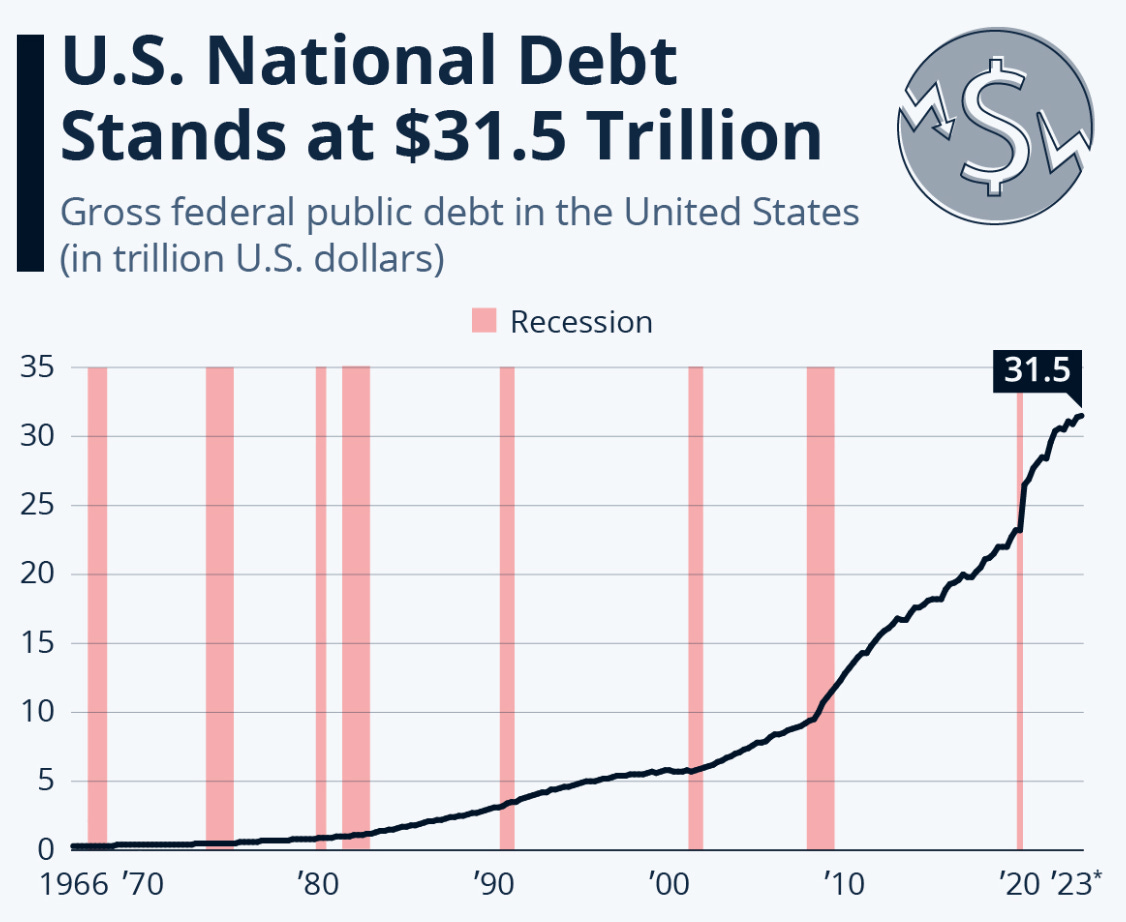

The US is currently adding $1tn of debt every 100 days. The US Debt-to-GDP ratio is around 125%. The US government budget deficit is $1.6tn.

The American government, the American people and American companies are borrowing more than they produce.

And so, today’s piece will focus heavily on the US; but many points can be extended to similar liberal democracies.

There comes a time, in every journey, when it must come to an end. Whether this be one’s life, a company, or a great civilisation, the end is inevitable.

Sometimes, the end is short & quick; as in the case of ‘Lehman brothers’, or the sudden dinosaur extinction.

But in the case of great civilisations, their fall tends to play out slowly, where they struggle for decades, until they are no longer great. They all too often follow this playbook:

Start as little → Grow into a behemoth power → Take on debt to defend that power → Print money to finance said debt → Suffer from inflationary pressures, debt defaults, decline in public services & military defeat.

Roman empire - Excessive military spending when occupying the entire 46,000km coastline and surrounding areas of the Mediterranean was a major cause of the Roman empire’s demise. In hope of salvaging their rotten balance sheets, their policymakers, like ours now, opted to debase their currency, which culminated in empire-destroying inflation and a plummet in living standards across the Empire.

Ottoman empire - Akin to the Roman empire, the Ottoman empire’s decline can be attributed to growing ‘too big for their shoes’, having to resort to loans and inorganic money printing to stay afloat. They devalued their Lira so much, others stopped ascribing value to it, spiraling into worthlessness. Without a valuable currency or a healthy fiscal budget, their military might tumbled in tandem.

Spanish Empire - Spain’s Habsburg monarchy declared bankruptcy 9 times between 1557 and 1666…throughout their supposed ‘golden era.’ After the conquest of South America, which expanded both the size and wealth of the empire, they developed a masochistic love for warfare. Over these 109 years, Spain fought in both the ‘80 years war’ and the ‘30 years war.’ Their newfound gold and silver wealth spurred inflationary pressure, which we now look back at as ‘The Price Revolution’ of western Europe.

So a long-winded, inflation-toxic, disgustingly-indebted, future might await the US hegemony.

It already has inflation.

And its government is certainly heavily indebted.

The bad news is that the “long winded” demise of civilisations may not apply to the US. For now we find ourselves in the age of accelerationism, where technological and social growth has led to extremities, capable of ushering in rapid and drastic change (eg: the surprise of Brexit, the insanely rapid adoption of chatGPT, the shift from highstreet banks to neo banks, and how EVERYONE went from watching cable TV to watching Youtube and Netflix in just a few years).

Here’s a wild fact for ya:

If you saved $500k every day since the Great Pyramid of Egypt was built, you’d still not have enough to finance the US government for 7 months. Factcheckers, go here.

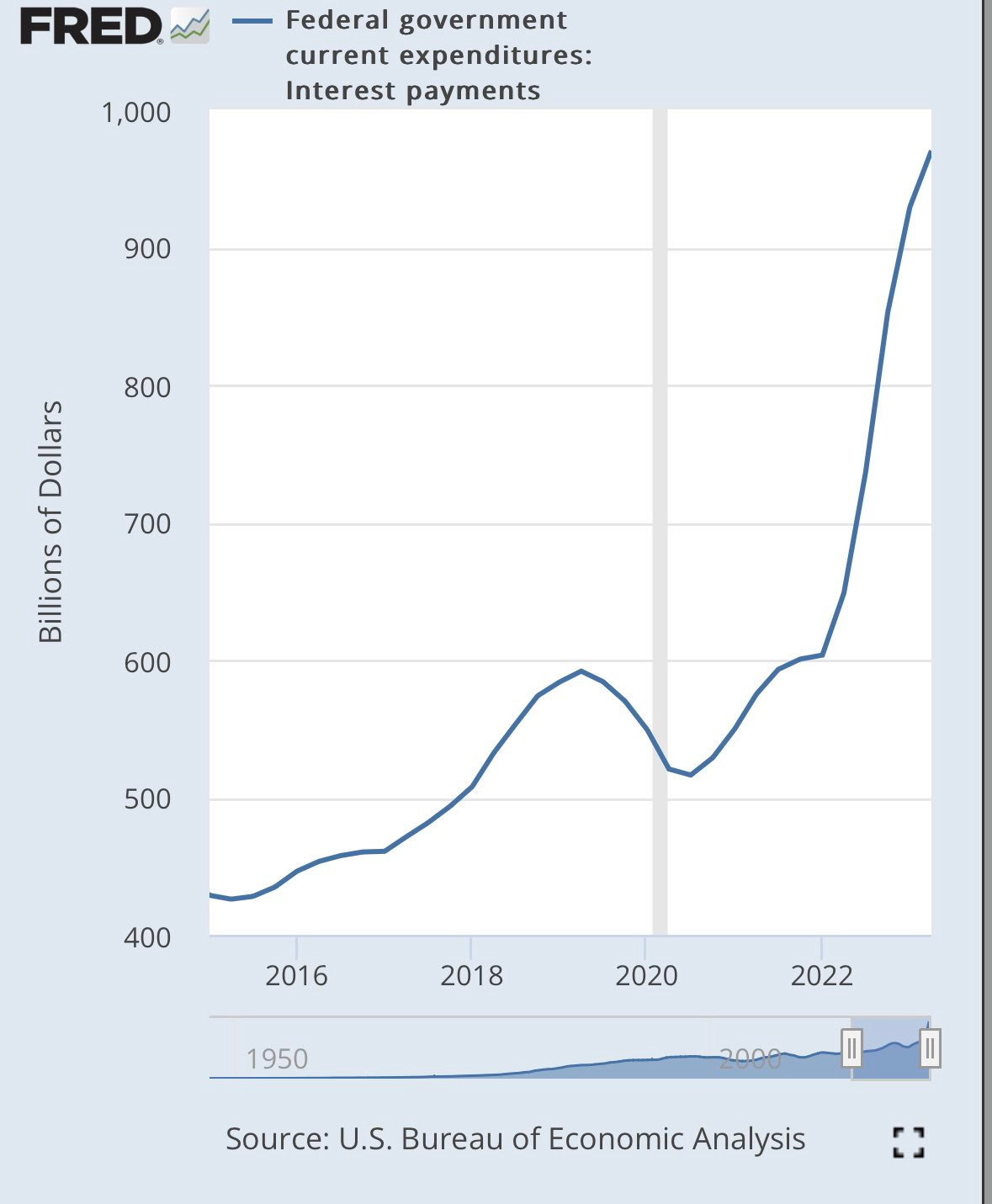

The key to grasping the colossal size of this shitshow is realising that interest compounds. Not only do you have to payback a colossal amount of money, but the interest that it levies too. Removing the debt obligation of $35tn to the side, the US is expected to pay circa $900bn this year just in interest payments! Equivalent to the annual GDP of Switzerland.

How will US pay off this debt and finance its debt payments? The school of economics that 21st century policymakers have subscribed to is ‘Modern Monetary Theory’ - the belief that debt is not a problem, as nation states can always print money to pay its obligations. It does not discourage debt, but encourages it. Leaders’ policies are not shaped by fears of rising national debt; as debt can always be paid for, either by printing worthless money, or selling the debt. This works; assuming there is always someone to buy your debt. All great empires had plenty buyers of their debt…until they disappeared (like the Venezians when they stopped financing the Byzantines).

To make matters worse, there is now a growing presence of other currencies and investment vehicles. Financiers can seek their yield in bonds of other nations that aren’t indebted (eg: Singapore) or even invest in an asset that cannot be inflated at whim (eg: Bitcoin or Gold). And circling back to accelerationism - we would be fools to ignore that it has never been easier to leave and abandon a currency.

Closing Thoughts

How can a nation propel its people into a prosperous future if its broke and indebted?

If we look at the US, and factor in how indebted its people, its government and its companies are…

How will it sustain and improve Medicare? To ensure Americans are healthy.

How will it provide financial aid to revolutionary technologies? To ensure Americans have opportunities to build wealth.

How will it support allies, while fending off enemies? To ensure Americans are safe and free.

How will it take gambles and build things that could sow generational fortune? To ensure Americans can live long and prosper.

None of this is possible if you are broke and indebted. To fix the system, you must fix the money.

Fixing this fiscal fiasco should be the single most talked about topic in public discourse today. Instead, electoral campaigns shine more focus to faux instant gratification (eg: increasing welfare, freezing public transport prices, and annulling student debt) than true delayed gratification (eg: balancing the public deficit and solving the long term debt crisis).

I will close this piece with a quote from Niall Ferguson - professor of History at Oxford, Harvard, LSE & Stanford.

“Any great power that spends more on debt service than on defense, will not stay great for very long.”

For context, the US has to pay circa $1tn in interest payments every year; while allocating a smaller $840bn to the military. UK pays $114bn in annual interest, and allocates $73bn to defence. Japan $190bn in interest, $55bn to defence.

What do you think happens next?

Nice read, also quite concerning since there is nothing we as citizens can do, other than hope that some politican will have the courage to reverse this. This also makes me think of the pensions problem in Spain, making a problem grow just because its easier to carry on doing the same thing and leave the problem for the later generation to solve

Great read !